For three generations we have guided affluent families and business owners in navigating the intricate intersections of wealth, tax and business strategies. At Clear Advice, we transform complexity into clarity.

Every successful journey begins with a clear, actionable plan. Our proprietary platforms: Family Financial Roadmap™ and Business Exit Roadmap™ are designed to integrate your family, business and wealth planning needs, optimize your tax strategy, and safeguard your legacy.

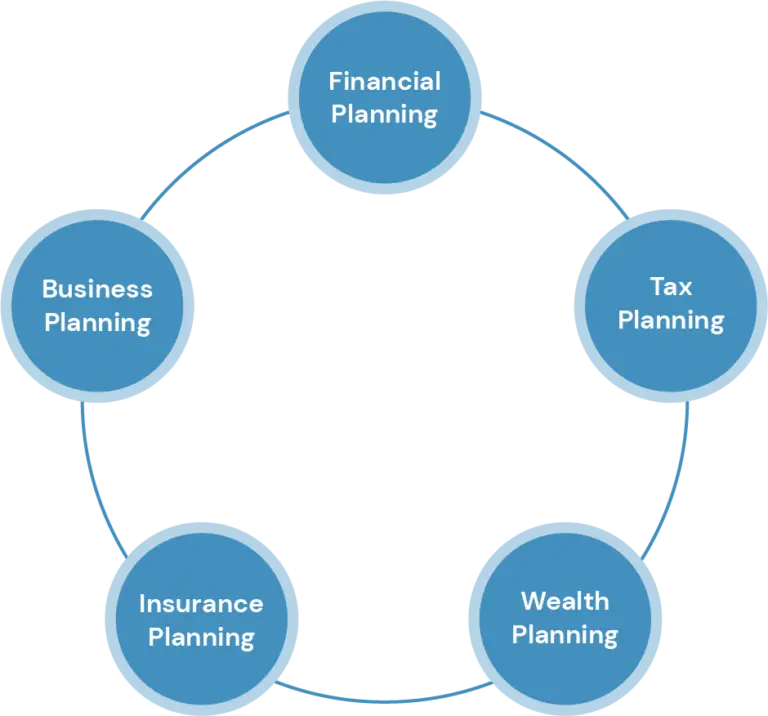

Ensure every aspect of your financial life is accounted for. By blending deep expertise in financial, tax, and business planning with the personalized touch of a boutique family office, we provide comprehensive oversight. This proactive approach helps you navigate complexities, optimize opportunities, and make informed, confident decisions.

Exit planning isn’t just an event—it’s a strategy. Our Certified Exit Planners help maximize value and minimize taxes:

Build Value

Protect Value

Monetize Value

A strong exit plan creates clarity, strengthens operations, and drives growth—setting your company up for long-term success, whether you’re exiting soon or later.

Integrated planning unifies estate, financial, and tax strategies into a seamless process. By coordinating across all aspects of your financial life, we eliminate inconsistencies, enhance communication across your professional advisory team, reduce fees, and empower you to make clear financial decisions based on facts.

Someone’s sitting in the shade today because someone planted a tree a long time ago.

Warren Buffet

We named Clear Advice with purpose—too many advisors offer unclear or misleading guidance. We set a higher standard by building strong client relationships and using a disciplined, process-driven approach. Our goal: to simplify complex financial challenges and deliver clear advice with meaningful results.

Securities offered through IFP Securities, LLC, dba Independent Financial Partners (IFP), member FINRA/SIPC. Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Advisor. IFP and Clear Advice are not affiliated.

Registration does not imply that the Firm is recommended or approved by the United States government or any regulatory agency. Registration with the United States Securities and Exchange Commission or any state securities authority does not imply any level of skill or training.

IFP may only transact business or render personalized investment advice in those states and international jurisdictions where it is registered, has notice filed, or is otherwise excluded or exempted from registration requirements. The purpose of this website is for information distribution only and should not be construed as an offer to buy or sell securities or to offer investment advice. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve results that are similar to those described. An investor should consider his or her investment objectives, risks, charges and expenses carefully before investing. Please refer to IFP Advisors LLC ADV Part 2 for additional information and risks.

Reg BI Disclosure Supplement | Form CRS | Investor Pricing | Privacy Policy | Business Continuity Plan

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors